Sizing up your data

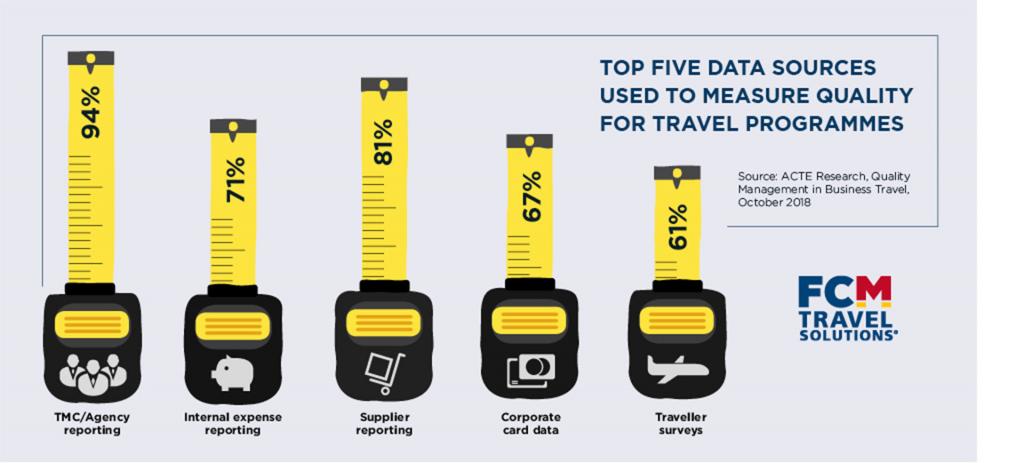

A 2018 ACTE survey of 300 travel managers found a startling disparity between the metrics that travel managers use to measure the success of their travel programmes and what is important, given the significant changes in the industry in the past two decades.

Greeley Koch, Executive Director, ACTE Global, said of the results: “The travel industry has evolved to a startling degree over the past 20 years, from one providing a deeply human, streamlined experience through travel agents, to one that embraces technology, customisation and traveller centricity. It is incumbent upon travel managers to adapt to this new reality and establish meaningful KPIs that capture not only the numbers—cost savings, hotel attachment, productivity—but also intangible elements, such as traveller safety and morale, and the programme’s impact on recruitment and retention efforts. No one within the organisation is better positioned to do this.”

The relatively new focus on data has emerged because there often comes a point in a travel manager’s life when they think to themselves “What now?”.

If you have a mature travel programme, you will have ticked off the things that a good travel manager is supposed to do. You will have consolidated data from a range of sources to find out the true nature of your travel patterns, your key air routes and the suppliers you are using more than any other. You will have used that data to consolidate to a lesser number of suppliers and leveraged your spend to get better deals.

"It is incumbent upon travel managers to establish meaningful KPIs that capture not only the numbers, but also intangible elements."

The travel programme is in good shape, true, but what now? Where do the gradual improvements come from?

Juan-Antonio Iglesias, FCM’s Head of Account Management for EMEA, says spend is important but is no longer the only requirement: “A decade ago air spend was the main focus. However, companies are now looking into land [hotel, car, etc] as new data has become available,” he says.

“Savings are still important for any client – all customers want to optimise their travel spend. However, as programmes mature savings will be lower and lower on a yearly basis. It is now more about traveller satisfaction, traveller behaviour, risk management and transforming the travel programme for future industry requirements.

But “data” is a very broad term - and just having volumes of it is no guarantee of programme success.

Specialist Data Consultancy

FCM’s specialist data consultancy is provided by its 4th Dimension (4D) business consulting team. 4D was launched in Flight Centre Group’s native Australia in 2014 and came to Europe and the UK last year. 4D focuses unashamedly on gathering data and getting a deep understanding of what it can do. “It is imperative to distinguish between quality and quantity - as with everything in life,” says Iglesias, who also acts as divisional leader for 4D in the EMEA region.

“Quality data doesn’t need gigabytes of detail. One of 4D’s main objectives is correct analysis of data, aligning our client’s culture with industry trends and the opportunities offered by understanding and influencing traveller behaviour, identifying savings opportunities and adopting the right supplier strategy.”

4D uses Connect, FCM’s global reporting tool, to analyse not just the traditional booking data from the TMC but overall T&E data. This holistic vision of spend and behaviour makes getting the right advice about where the programme is going far easier.

With large volumes of data come concerns about data security. A survey of travel managers for the Business Travel Show in early 2019 found that data security was their number three concern after duty of care and traveller wellbeing.

Analytics, sourcing, elevate and research

4D’s service is built on four pillars, two of them relating to data: it will never share a company’s data unless the travel manager requests this and promises to protect and secure the information a company shares. This emphasises the importance that data now has. The other two relate to 4D acting independently and on a fee basis, meaning there will be no bias introduced through earning commission from preferred suppliers.

4D’s Analysis services include cost savings analyses, comparative benchmarking of suppliers, data consolidation from GDS as well as non-GDS and wider industry sources, demand management as well as traveller satisfaction ratings.

The key benchmark indicators 4D use include traditional measures such as average air ticket price and average hotel room rate but also percentage compliance with preferred suppliers and, in recognition of the importance of traveller wellbeing, the number of trips or days away per year, all compared with industry averages.

Data snapshots

Looking at demand management is increasingly important. Research from 4D says that focusing on the need and reasons for travel, as well as finding alternatives, can drive as much as 45% of savings within a travel programme, compared with the 33% achievable just from looking at suppliers.

One way the company is using data more smartly is in providing what it calls “Data Snapshots” directly to travellers. In the past, travel management reporting was all about a travel management company account manager running a report, sending that to the travel manager, who would use it to identify departments with non-compliant behaviour. The travel manager would then spend precious time searching through all of this data, speaking to the relevant business managers and informing them of which travellers were costing the company unnecessary spend.

With Data Snapshots, FCM engages the traveller directly with details of their booking behaviour, both positive and negative. Using ‘nudges’ that both congratulate and warn travellers about their behaviour is vital to keep them onside with a travel programme.

A typical snapshot might include the average advance booking window that a particular traveller books in and the typical savings or loss that the traveller makes compared to the average within the company. The snapshots also include an element of gamification, showing where the traveller sits within the company in terms of traveller behaviour, thus nudging them to make the “right” choices.

FCM and 4D are also offering free data health checks to both existing clients and prospects to get a better idea of the shape their data is in.

In the wider world, in the light of the Facebook privacy scandal and the unstoppable rise of tech giants like Google and Amazon, individuals have begun to realise that their data has immense value and needs to be protected and not shared indiscriminately.

The data that company travel programmes generate also has significant value. Yet tapping into it is a much bigger task than unearthing the nuggets hidden in the behaviour of individuals. Working with partners like FCM and 4D to analyse the vast and growing volumes of data is vital for travel managers to unlock the potential of their travel programmes as the industry changes and spend.