GUIDE

Prepare your ancillary strategy for 2026

“There’s one word to describe the aviation sector in the first half of 2025: resilient,” says Jason Kramer, Global Air Practice Lead at FCM Consulting.

According to the FCM Consulting Insights Report, while year-over-year global demand is up (5.8%) and being paced on the strength of Europe, Latin America, Asia-Pacific, Middle East and Africa, demand in North America is flat amidst trade policy and broader macroeconomic conditions.

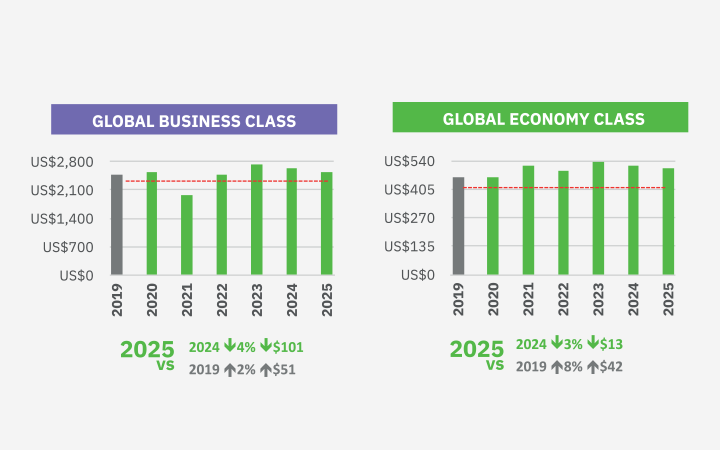

Despite moderate demand improvement year-over-year, global airfare year-to-date is down in both business class (4%) and economy (3%) from to the same period in 2024. The year-over-year decline is primarily attributable to demand not matching original forecasts and airlines having to adjust pricing strategies to stimulate demand.

Ancillary revenue: the airlines’ second wallet

Airlines, however, are not short on means to generate revenue. While the base fare remains core, ancillary spend continues to be an enormous revenue-generating stream. In 2024, airlines generated about US$150 billion in ancillary revenue. That’s an increase of around US$32 billion from 2023.

While co-branded credit card revenue represents the largest percentage of the approximately $150 billion, airlines are increasingly adopting sophisticated strategies to maximise ancillary revenue (such as baggage fees, upgraded seats, and priority boarding) and personalised offers including fares and ancillaries, based on passenger data.

“While the base fare remains the fundamental element of airline revenue, ancillary income streams have become increasingly critical for profitability, stability, and shaping the modern airline industry business model,” says Kramer in the report.

This “second wallet” that airlines are after is critical to mitigate and help offset rogue and increasing spend within your air and travel programme.

5 steps to build an ancillary policy

The good news is that organisations can take control through smart air programme management. A travel policy that addresses ancillary fees in a structured and enforceable way will help manage costs, improve traveller experience, and ensure compliance.

Putting these rules in place will help travel managers create consistency, increase traveller satisfaction, and reduce disputes over what qualifies as reimbursable.

Here’s how it can be done:

1. Define what counts as ancillary fees

Clearly list ancillary services, such as:

- Checked baggage

- Seat selection (standard vs. premium)

- Priority boarding

- In-flight Wi-Fi or meals

- Lounge access

- Change/cancellation fees

2. Set allowable vs. non-allowable fees

Create rules based on traveller type, trip purpose, or fare class:

| Fee Type | Allowed? | Conditions |

| 1st checked bag | ✅ Yes | For trips >3 days |

| Seat selection | ✅ Yes | Only standard seats |

| Wi-Fi | ❌ No | Unless for business class |

| Lounge access | ✅ Yes | For execs or long layovers |

| Extra legroom seat | ❌ No | Unless medically required |

3. Define payment and reimbursement rules

- Require use of a corporate card for tracking

- Set spending limits per category

- Require itemised receipts for reimbursement

4. Use booking tools to enforce policy

- Implement pre-trip approval workflows for exceptions

5. Educate travellers

- Include a quick-reference guide in onboarding materials

- Use automated reminders in booking tools when out-of-policy choices are made

Using supplier relationships to reduce fees

Policy is one side of the equation. Supplier negotiations are the other. A managed travel programme can work with airline suppliers to eliminate or reduce ancillary fees through strategic negotiation, data-driven planning, and leveraging distribution technologies. Here's how:

1. Use traveller data to strengthen negotiations

- Analyse historical spend on ancillaries by route, traveller type, and airline.

2. Include ancillary fee waivers in contracts

- Ask for fee waivers for specific traveller groups (e.g., executives, frequent travellers).

- Include flexibility clauses for changes/cancellations without penalty.

3. Align travel policy with supplier agreements

- Ensure the travel policy reflects negotiated benefits (e.g., “seat selection included for all preferred airline bookings”).

- Communicate these benefits clearly to travellers and travel arrangers.

4. Collaborate with TMCs and GDS providers

- Work with your travel management company (TMC) to enforce ancillary fee rules.

- Ensure your Global Distribution System (GDS) or booking platform supports fare families and ancillary visibility.

The path ahead for managing ancillaries

Corporate travel professionals will need to stay sharp as the year progresses. Airlines are innovating to drive ancillary revenue, and unmanaged spend can quickly erode travel budgets. With the right mix of policy, education, and supplier engagement, organisations can keep costs predictable, and travellers satisfied.

Supplier insights your travel programme can’t afford to miss

Things are changing fast in the global economy and travel suppliers are adjusting their offerings to keep up. Managing ancillary fees only scratches the surface. The complete FCM Consulting Insights Report goes deeper, breaking down new air and hotel strategies, regional outlooks, and key considerations for risk management.

Prepare your travel programme for what’s next.