INSIGHTS

Top corporate travel trends to watch in 2024

Defying expectations, corporations adapted their budgets and policies in the face of escalating travel expenses throughout 2023. What does 2024 hold? FCM Consulting’s latest predictions show confidence among corporate travelers is at an all-time high. This is driving a surge in planned business growth, client engagement, and colleague connections. But some challenges in North America ensure.

Keep reading for more insights into the latest travel trends.

Global costs of business travel

Travel program budgets were at the forefront for most companies in 2023. This could remain a priority into 2024 as predictions travel prices for airlines, hotels, and car rental will continue to rise at approximately +3% across the G20 group*.

The only exception? Europe, where the weakened economy may force consumer prices to remain flat or decline where demand reduces. However, the majority of the remaining countries are showing positive trends and lowering of inflationary pressure.

At the same time, a growing trend in accommodation is predicated for 2024 in North America and Europe. Dynamic discounts off Best Available Rate (BAR) could be replacing the traditional fixed rate at hotels. The downfall? Dynamic discounts result in corporates riding the price highs and lows of hotel rates with a 10-20% saving, making it hard to budget.

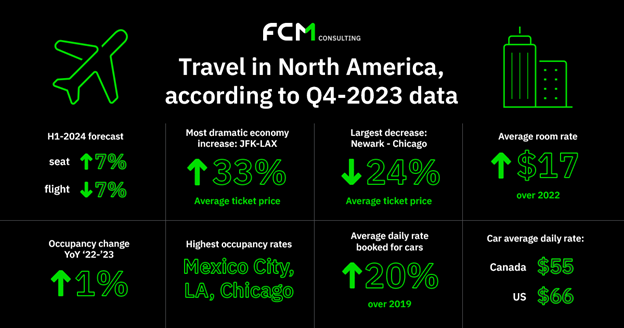

Additionally, car hire for the year end of 2023 saw the global Average Daily Rate (ADR) at $73 (+$20) on 2019). The United States and Canada, saw a $66 and $55 ADR, respectively. Notable, over 2023 the global ADR remained relatively flat.

KEY TRAVEL TECH TAKEAWAYS:

-

On average, global travel costs predicted to rise +3% with Europe to remain flat or decline.

-

H1-2024 is forecast to offer +3.5% more seats, and -5.6% less flights than H1-2019.

-

Jet fuel barrel prices fell below $102, the lowest for the full year of 2023.

Business air travel trends

Our experts predict we’ll be seeing more seats with less flights globally into 2024, with the first quarter of the year forecast to offer +97.9M (+3.5%) more seats, and -2.1M (-5.6%) less flights than H1-2019. This is a result of fleet configuration changes and shifts in schedules to meet demand.

Africa will buck the trend with forecasts set to rise in seats by 11% and flights by 6%, while Europe is predicated to see a decline in seats of 1% and flights of 8%. North America will be at 7% increase in seats and a 7% decrease in flights.

Across Top Global Corporate Airlines, a forecast of seats offered in 2024 will be +2% above 2019 and flights offered -6%. Meanwhile, 13 of the Top Global Corporate Airlines are predicted not to return to 2019 levels during 2024.

KEY TAKEAWAYS FOR AIR TRAVEL:

-

Airlines in the home markets of China and India lead Asia's growth. The top Chinese airlines, in percentage terms, will offer +21% more seats in 2024 vs 2019.

-

Airline growth across other regions include standout airlines: Regional Express (+92%), FlyDubai (+56%), and Ryanair (+39%) by percentage growth 2024 vs 2019.

-

Across 380 City Pairs, Economy Airfares were up $76 (+17%) and Business up $246 (+15%). The largest North America city pair ticket increase was from JFK-LAX, with an increase of +33%.

Corporate travel management insights

As corporate travel boomed in 2023, the last quarter of the year saw travel managers focusing on making things easier for their travelers. How? By using communication channels, clear policy guidelines, and sharing new distribution capabilities (NDC) choices when market ready.

Travel is predicted to surpass pre-2019 levels this year, despite tight corporate travel budgets due to total trip expenses remaining high. The flow on effect of more corporate travel means both experienced road warriors and newer business travelers will need help navigating travel policies, as tensions can rise when the travel policy guidelines differ to traveler expectations.

At the same time, Amadeus reports corporate travelers prefer business class over economy, because once you try it, it’s hard to go back! This is the sentiment of travelers who have flown business class long-haul and looked back at economy class. Travelers who prefer business class will be interested to know that over the past four years, six airlines have developed fares with more or less business class price options, including Business Luxe and Business Lite.

KEY TAKEAWAYS FOR 2024:

-

New distribution capability is in the spotlight, with predictions 2024 is the year when NDC adoption takes off globally in the corporate travel space.

-

In 2024, travel offered to both corporate and leisure combined is set to surpass annual travel spend in 2018 and 2019.

*The G20 is made up of 19 countries (Argentina, Australia, Brasil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Korea, Mexico, Saudi Arabia, South Africa, Russia, Türkiye, UK and USA) and two regional bodies: the African Union and the European Union. The members of the G20 represent around 85% of the world's GDP, more than 75% of world trade and around two-thirds of the world's population. Source: https://www.g20.org/en/about-the-g20